ATB Financial is a full-service financial institution in Calgary, Alberta, with 5,146 employees and more than 700,000 customers. Three of ATB's key priorities are to transform banking, make banking work for people, and be the place to bank. In October 2016, ATB Financial launched a new mobile banking app for its customers to do just that. Mobile banking has become a popular choice for fulfilling everyday banking needs and continues to trend upwards in popularity. In fact, a 2016 Canadian Bankers Association survey, How Canadians Bank, found:

ATB Financial is a full-service financial institution in Calgary, Alberta, with 5,146 employees and more than 700,000 customers. Three of ATB's key priorities are to transform banking, make banking work for people, and be the place to bank. In October 2016, ATB Financial launched a new mobile banking app for its customers to do just that. Mobile banking has become a popular choice for fulfilling everyday banking needs and continues to trend upwards in popularity. In fact, a 2016 Canadian Bankers Association survey, How Canadians Bank, found:

- 44% of Canadians reported using mobile banking during the last year, up from 31% in 2014 and just 5% in 2010.

- 38% say their use of mobile banking is increasing, particularly among younger Canadians (66%), while 45% of those over 55 say their use of mobile banking is either increasing or staying about the same.

- 9% of Canadians say that taking a picture with their mobile device is their primary means of depositing a check, up from 1% two years ago.

- 52% of Canadians believe that they will be conducting more of their banking using a mobile device over the next two to three years.

While the previous version of ATBs Retail Mobile app allowed customers to engage in their most common financial transactions, online and mobile banking analytics showed when viewing their online banking from their mobile devices (phone or tablet), 1 in 3 ATB customers accessed their account by visiting ATB Online (atbonline.com) via their internet browser instead of using the ATB Mobile app. With the launch of the retail ATB Mobile 3.0 app, ATB focused on enhancing the mobile banking experience by providing a more intuitive interface, better speed, improved performance and more transaction options. Some of the highlights of the new app included mobile check deposit, touch ID sign on, increased security, fulfilling customer needs and improving the customer experience. To be successful, though, we needed to do more than develop a smart, simple and helpful app with a great customer experience. We needed to increase adoption by transitioning existing users to the new version of the app, increase the overall app user base with net new users, and specifically focus on converting customers to start using the mobile app instead of their browser in order to get the benefits of this superior experience. With this in mind, our internal communication team needed to ensure that ATB team members were aware of the new app, and understood how it worked and why they should be excited about the new version prior to its launch. This would ensure they were confident talking about and recommending the app to customers when it became available and to create advocates to drive us forward in our initiative to make ATB the place to bank among team members. The primary audience for the communication effort was personal banking frontline (customer-facing) team members and their leaders (46% of all team members. The secondary audience was all 5,146 ATB team members. Prior to creating the communication plan, the communication, organizational change management, marketing and training leads conducted needs assessments with leaders from our various stakeholder groups. The following themes emerged when we asked about attitudes, opinions and the general sentiment of their team members:

- Team members want to know about the platform and how it works in case their customers ask them about it.

- When explaining new digital products to customers, team members want to be able to show customers what they're talking about, without having to pull out their personal device connected to their personal banking accounts.

- Leaders want to understand what we're trying to accomplish and how they can support the organization in being successful.

- Leaders want to understand how this fits within our overall corporate strategy.

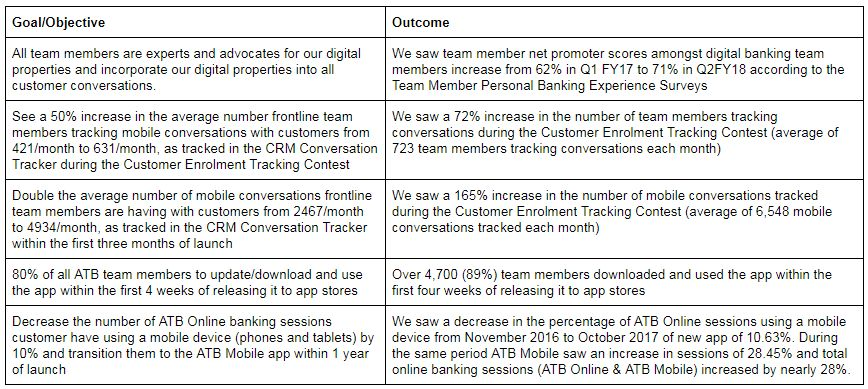

We set the goals for the ATB Retail Mobile 3.0 communication plan to connect the project goals---increasing awareness, creating excitement and driving overall adoption of the new app---with the goals outlined in ATBs corporate strategy:

- All team members are experts and advocates for our digital properties and incorporate our digital properties into all customer conversations.

- Each of our 5,146 team members immerse themselves in our banking and investment experience and be accountable for providing ATB with feedback to help us become the place to bank in Alberta.

Objectives: Personal Banking frontline team members:

- See a 50% increase in the average number frontline team members tracking conversations about mobile banking with customers from 421 a month to 631 a month, as tracked in the CRM Conversation Tracker during the Customer Enrolment Tracking Contest.

- Double the average number of mobile conversations frontline team members are having with customers from 2,467 a month to 4,934 a month, as tracked in the CRM Conversation Tracker within the first three months of launch.

All ATB team members:

- 80% of all ATB team members update/download and use the app within the first 4 weeks of releasing it to app stores.

Additionally, the communication strategy will contribute to the overall project objective to:

- Decrease the number of ATB Online banking sessions customer have using a mobile device (phones and tablets) by 10% and transition them to the ATB Mobile app within 1 year of launch in order to provide customers with a better customer experience.

The solution

In order to achieve our objectives, we developed a three-phase approach: Leaders awareness: We knew from our assessments, and surveys conducted by internal communication and the ATB customer insights team, that team members prefer to receive information from their leaders. With this in mind, the purpose of the Leaders Awareness phase was to inform and excite frontline leaders in advance of communication being shared with their teams and to provide them with the details needed to lead the change at the local level. Targeting leaders specifically would support our goal of frontline team members being aware of the new mobile app and understanding the key features, so they could confidently demo and recommend the app to customers. Team member awareness: The purpose of the team member awareness phase was to use a number of different channels and media, including intranet posts, newsletter articles, videos, simulators and FAQs€”rolled out over a four week period prior to launch€”to support our Personal Banking frontline team members' understanding of the new mobile app and how it would benefit the customer experience. Post-launch, we would need to continue to be transparent about future releases and also address issues/bugs and what we were doing to resolve them.

A demo video explaining the features of the new app was part of the outreach to employees. Promotion & Contests: The purpose of the Promotion & Contests phase was to let all team members know the app was now available, encourage them to download and start using it for themselves, and to change Personal Banking frontline team members' behavior by challenging them to talk about new digital products with customers. We knew from our assessments and by analyzing past behaviors that our team members are motivated by rewards, recognition and friendly competition, so we wanted to leverage this with challenges and contests.

An award-winning program

This campaign won a Gold Quill Award of Excellence for Internal Communication in 2018. IABC's Gold Quill Awards program evaluates the work of communication professionals around the globe, recognizing the best of the best in the profession.

Key messages: We focused our messaging on the customer experience (new features and functionality) and the fact that we are committed to staying current within an ever-changing banking environment. We needed our audience to realize that we created the new app to make banking work for people, and giving customers what they asked for, by providing a better overall customer experience with a more intuitive interface, better speed, improved performance and more transaction options. We also focused on the importance of team members using, experiencing and becoming advocates for our digital properties.

The results

In order to measure how successful we were at achieving our objectives, we used:

- Results from Team Member Personal Banking Experience Survey.

- Reports pulled from our CRM system to show behavior change in number of team members having and tracking conversations with customers.

- A transactional report pulled by our internal data team to determine the number of team member who downloaded and were using the new app.

- Google Analytics on the usage of our ATB Online banking site and ATB Mobile app.

It's also worth noting the Customer Enrolment contest was deemed so successful at changing frontline team member behavior, RFS Operations replicated the contest and ran it again from January to 31 March 2017 in order to continue to increase team member advocacy of our digital channels and continue the promotion of the ATB Mobile app.

Nekolina LauFor more than 15 years, Nekolina Lau has been working in marketing and communication within retail, oil & gas, nonprofit, government and academic industries. For the past 10 years, she's been focused specifically on driving adoption and engagement through the lens of internal/employee and executive communication.